Electric trucks: new study pinpoints precise locations for charging infrastructure across EU

Brussels, 9 June 2021 – A new study conducted by Fraunhofer ISI on behalf of the European Automobile Manufacturers’ Association (ACEA) indicates key locations for the future deployment of charging points for battery electric trucks.

The study’s unique dataset can be used to help map out an EU-wide network of truck charging points, including at long-haul and regional stop locations in the European Union, the UK and other countries in Europe.

“The market uptake of electric trucks is set to surge over the next few years. However, the infrastructure necessary to charge these trucks is still sorely lacking, so it needs to be rolled out as a matter of urgency,” said Eric-Mark Huitema, ACEA Director General.

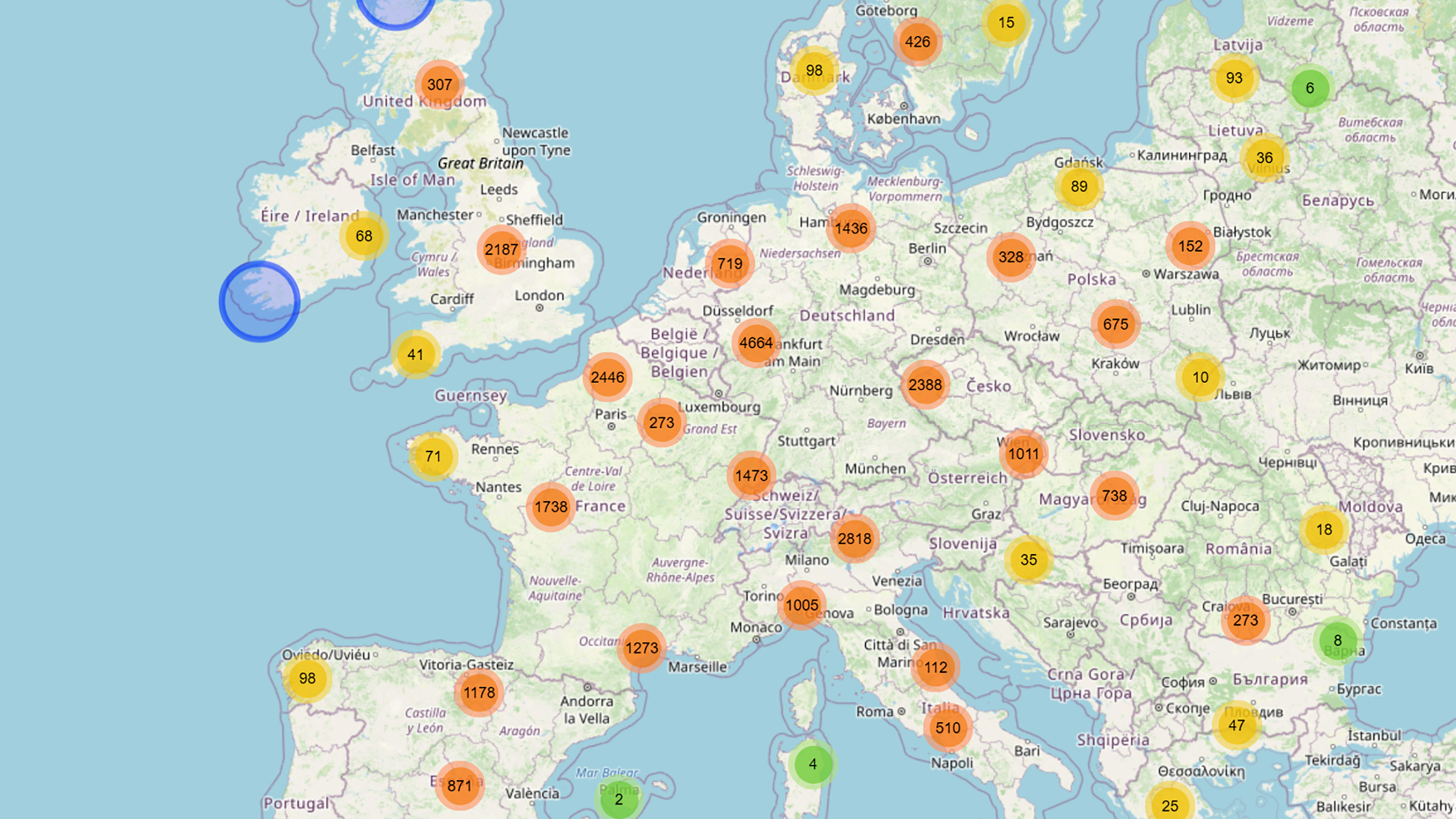

The future location of charging stations should be based on the current operation patterns of vehicles, according to the study. To identify these sites, Fraunhofer analysed 30,000 aggregated truck stop locations. This information, based on the logistics activity of some 400,000 trucks using 750,000 individual stops, was collected by the seven European truck manufacturers.

It shows that the truck stop locations are concentrated around highly populated areas in central Europe. They are denser around important industrial areas and major cities – such as Northern Italy, Paris, Greater Manchester, Berlin and Frankfurt – and follow main European roads.

About one third to one half of the stops are in rest areas close to motorways, according to the new data. Approximately one quarter to one third are at company sites or logistic hub locations, with just 1% to 5% in ports and ferry terminals.

There are two main categories of stopping time: less than three hours (with 35% between 30 and 60 minutes), and longer than eight hours. The high frequency of shorter stops, as well as the driving and rest time rules, highlight the need for high-power charging points suitable for re-charging trucks in a short amount of time.

This new analysis provides a good indication of suitable sites for charging infrastructure from a logistics and operational perspective. Further analysis using other criteria (eg available power grid capacity, local considerations, existence of charging infrastructure for electric cars, etc) will be required for investment decisions.

The market uptake of electric trucks is set to surge over the next few years. However, the infrastructure necessary to charge these trucks is still sorely lacking, so it needs to be rolled out as a matter of urgency.

Notes for editors

- The ‘Truck Stop Locations in Europe’ report can be found here: https://www.isi.fraunhofer.de/content/dam/isi/dokumente/cce/2021/ACEA_truckstop_report_update.pdf

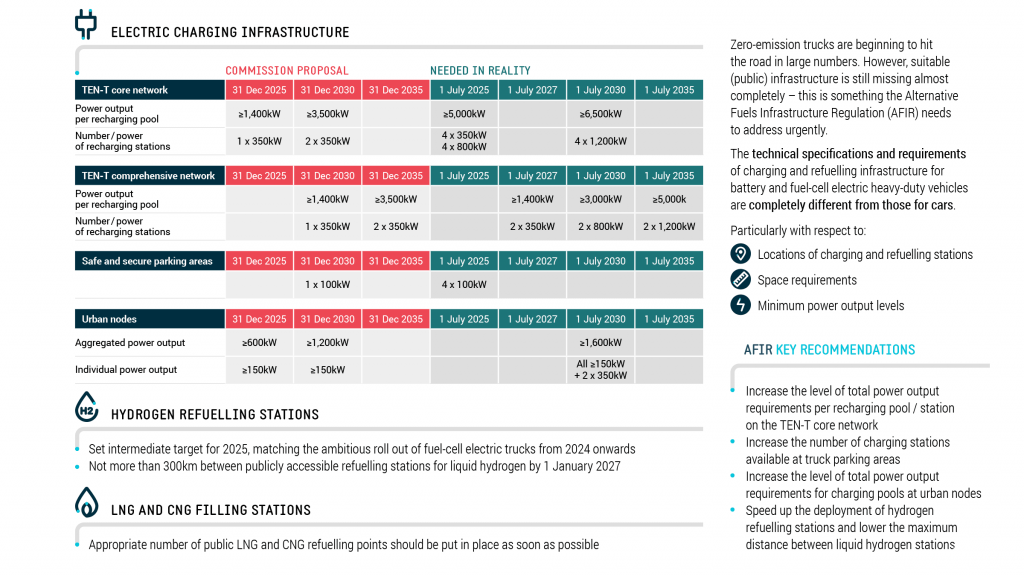

- The European Commission will publish its proposal for a review of the Alternative Fuels Infrastructure Directive (AFID) in July, as part of its ‘Fit for 55’ package.

About ACEA

- The European Automobile Manufacturers’ Association (ACEA) is the Brussels-based trade association of the 15 major car, van, truck and bus producers in Europe.

- The ACEA commercial vehicle members are DAF Trucks, Daimler Truck, Ford Trucks, Iveco Group, MAN Truck & Bus, Scania, Volkswagen Commercial Vehicles, and Volvo Group.

- Visit www.acea.auto for more information about ACEA, and follow us on www.twitter.com/ACEA_auto or www.linkedin.com/company/ACEA/.

- Contact: Cara McLaughlin, Communications Director, cm@acea.auto, +32 485 88 66 47.

Interested in ACEA press releases?

Receive them directly in your inbox!

About the EU automobile industry

- 12.9 million Europeans work in the automotive sector

- 8.3% of all manufacturing jobs in the EU

- €392.2 billion in tax revenue for European governments

- €101.9 billion trade surplus for the European Union

- Over 7% of EU GDP generated by the auto industry

- €59.1 billion in R&D spending annually, 31% of EU total