Electric trucks: new data maps out priority locations for charging points

Brussels, 24 May 2022 – New analysis conducted by Fraunhofer Institute for Systems and Innovation Research ISI on behalf of the European Automobile Manufacturers’ Association (ACEA) will help governments and infrastructure operators prioritise where to start installing charging points for electric trucks.

“Battery electric trucks will play a major role in decarbonising road freight transport. If enough charging stations are rapidly installed across the EU, their market uptake will increase exponentially over the coming years,” stated Martin Lundstedt, Chairperson of ACEA’s Commercial Vehicle Board and CEO of Volvo Group.

“Given that charging stations that are suited to the specific needs of trucks are almost completely missing today, the challenge ahead is huge. That is why we want to help governments and industry stakeholders to direct their investments to where they are most needed,” explained Lundstedt.

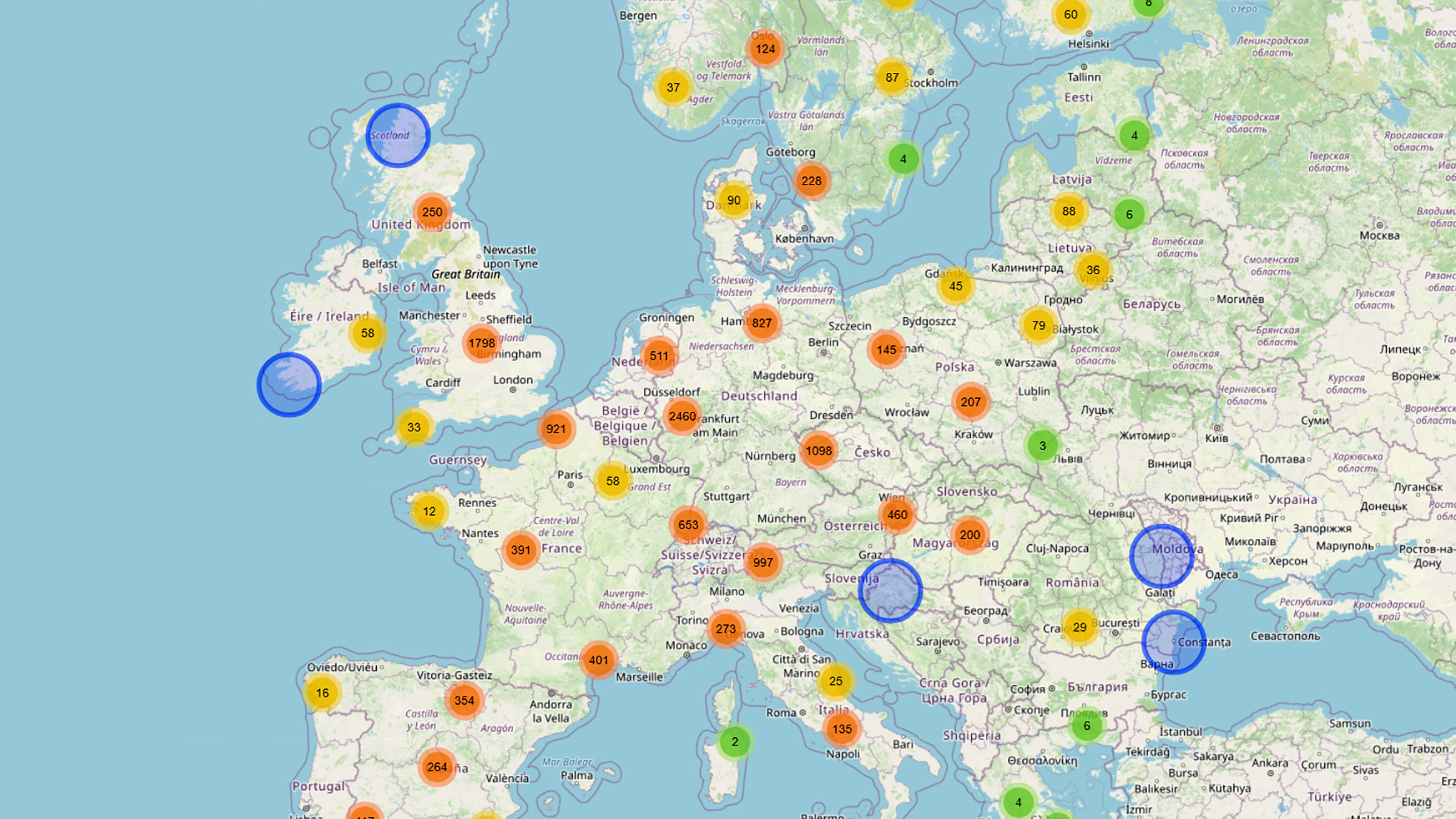

As truck operators make the switch to electric vehicles, it is unlikely that they will change their driving behaviour. The aim of this study is therefore to map out exactly where drivers make their stops today, and which of these truck stops are most frequently used.

Fraunhofer ISI analysed the GPS coordinates of some 400,000 trucks in operation throughout Europe over a period of 12 months, focusing on the duration of stops at individual locations. The analysis found that 10% of the locations most frequented by trucks in Europe (over 3,000) account for some 50% (78,000) of total stops that trucks make.

With this in mind, ACEA is calling on national governments to ensure that the top 10% truck stop locations within their countries are equipped with suitable electric chargers by 2027 at the latest.

The precise locations of all truck stops in 29 European countries are shown in five regional maps: central Europe, northern Europe, south-eastern Europe, southern Europe and western Europe.

The maps also distinguish the different stopping times of trucks – short stops (under an hour) and long stops (overnight parking). This is important as the duration determines the charging needs, such as the time available for a full recharge and the required power output. The maps also identify exactly where the most used truck stops are found (mainly in rest areas along motorways, company sites, logistic hubs and ports).

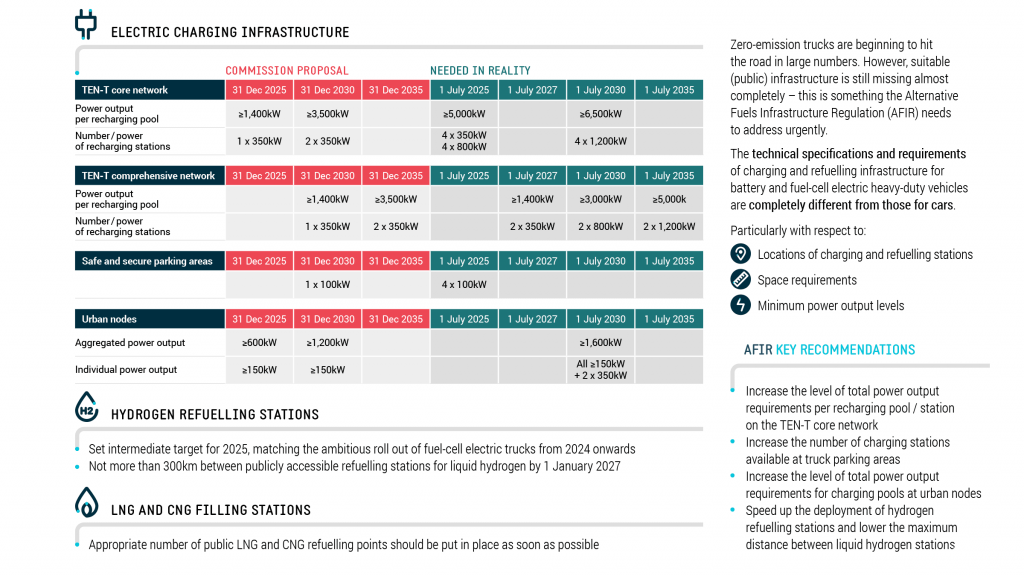

As MEPs and EU ministers prepare their final positions on the Alternative Fuels Infrastructure Regulation (AFIR), ACEA is calling for dedicated and ambitious targets for truck-specific infrastructure for each member state.

Given that charging stations that are suited to the specific needs of trucks are almost completely missing today, the challenge ahead is huge. That is why we want to help governments and industry stakeholders to direct their investments to where they are most needed.

Notes for editors

- The regional maps can be found here:

- Central Europe: https://www.acea.auto/figure/interactive-maps-electric-trucks-stop-locations-central-europe/

- Northern Europe: https://www.acea.auto/figure/interactive-maps-electric-trucks-stop-locations-northern-europe/

- South-eastern Europe: https://www.acea.auto/figure/interactive-maps-electric-trucks-stop-locations-south-eastern-europe/

- The identified locations are suitable for the roll-out of charging infrastructure from a logistics point of view. Defining exactly which locations to use and how many charging points each should have requires additional analysis and an evaluation of criteria such as: available electricity grid power, existing local initiatives, DC electric charging infrastructure for passenger cars already present, etc.

- This is one of the biggest analyses of real-world data, examining some 30,000 aggregated truck stop locations. This information, based on the logistics activity of 400,000 trucks using 750,000 individual stops over a period of 12 months, was collected by the seven European truck manufacturers. The availability of input data varied across regions, being lower for some countries (eg in eastern Europe).

- A fact sheet about the Alternative Fuels Infrastructure Regulation and the infrastructure required for heavy-duty vehicles such as trucks can be found at: https://www.acea.auto/fact/fact-sheet-alternative-fuels-infrastructure-regulation-heavy-duty-vehicles/.

About ACEA

- The European Automobile Manufacturers’ Association (ACEA) represents the 15 major Europe-based car, van, truck and bus makers: BMW Group, DAF Trucks, Daimler Truck, Ferrari, Ford of Europe, Honda Motor Europe, Hyundai Motor Europe, Iveco Group, JLR, Mercedes-Benz, Nissan, Renault Group, Toyota Motor Europe, Volkswagen Group, and Volvo Group

- Visit www.acea.auto for more information about ACEA, and follow us on http://www.twitter.com/ACEA_auto or http://www.linkedin.com/company/ACEA/

Contact:

- Cara McLaughlin, Communications Director, cm@acea.auto, +32 485 88 66 47

- Ben Kennard, Content Editor and Press Manager, bk@acea.auto, +32 485 88 66 44

About the EU automobile industry

- 12.9 million Europeans work in the automotive sector

- 8.3% of all manufacturing jobs in the EU

- €392.2 billion in tax revenue for European governments

- €101.9 billion trade surplus for the European Union

- Over 7% of EU GDP generated by the auto industry

- €59.1 billion in R&D spending annually, 31% of EU total